How Earned wage access creates an impact on your business?

Earned Wage Access reduces Employee attrition and Increases the Morale.

In this Article

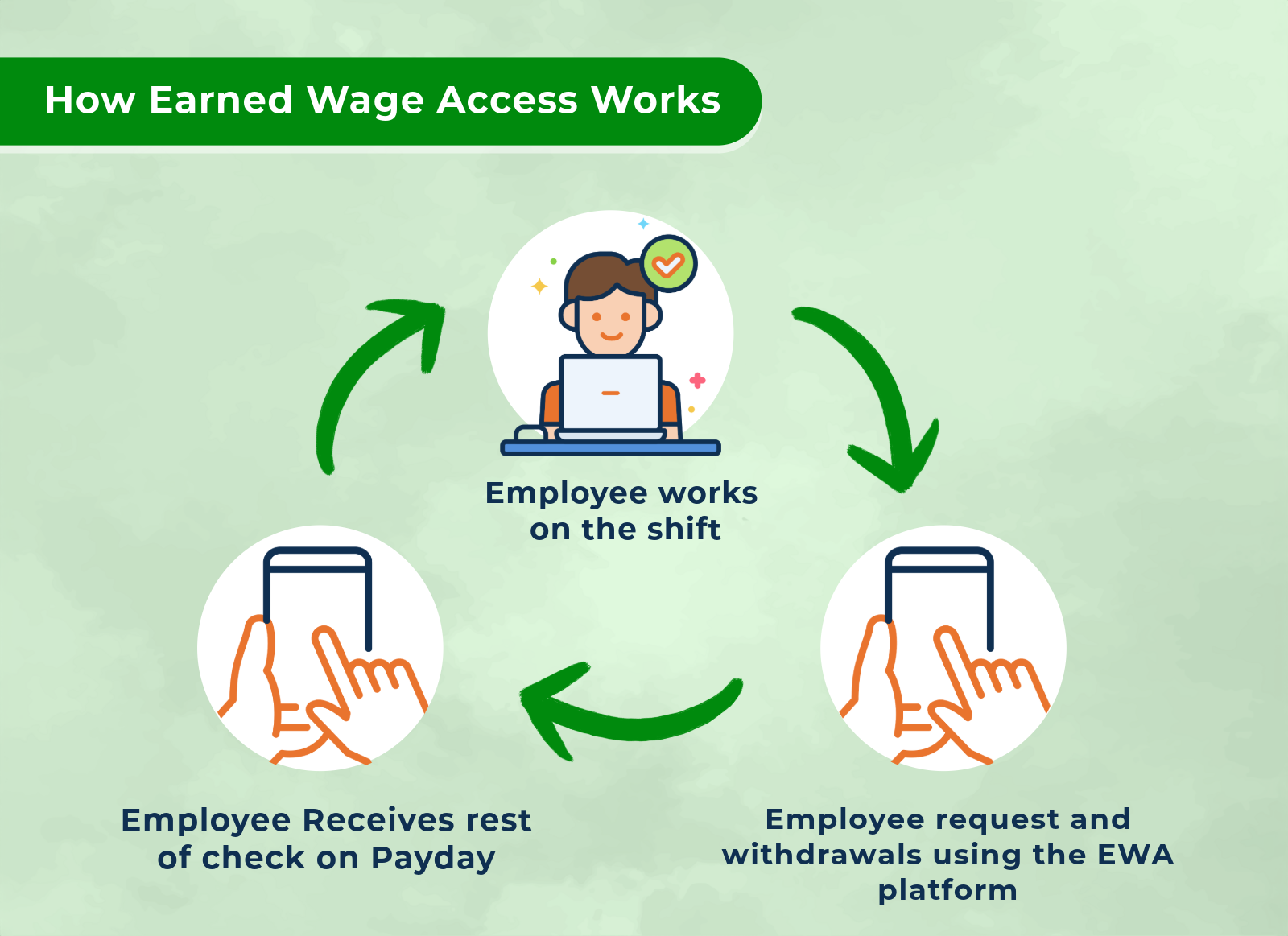

What is Earned Wage Access?

An earned wage access platform lets employees choose when to receive their pay instead of waiting for a traditional payday.

With this flexibility, employees can better manage their finances and avoid costly loans that harm credit with high fees or interest.

Now, it’s not about if companies will offer this benefit, but when.

Nearly half (49%) of My Day Pay Day users say earned wage access makes them feel more motivated at work.

As demand grows, more employers are looking to offer earned wage access to meet employees’ needs for flexible pay options.

What are the Benefits of Earned Wage Access?

Earned wage access offers numerous advantages for both employers and employees. Here’s a look at how each can benefit:

Earned Wage Access Benefits for Employers

Beyond meeting employee demand, employers should consider the broader benefits of earned wage access for their company.

In fact, 89% of employees report feeling more motivated and productive when they can access their pay on their own schedule.

Increased Employee Retention

A Study shows that 95% of companies offering an EWA solution today see a positive impact on employee retention. Higher retention helps reduce hiring costs and boosts morale across the team.

Higher Employee Engagement

Research by My Day Pay Day highlights that employees distracted by financial worries are less engaged at work. Offering a strong employee experience, including EWA, helps employees feel valued and supported, which leads to greater engagement and retention.

Increased Employee Productivity

Earned wage access (EWA) can significantly boost workplace productivity by easing financial stress, enhancing morale, and attracting high-caliber talent. EWA allows employees timely access to earned wages, empowering them to manage finances effectively and stay focused on their work.

Better Customer Outcomes

Motivated and engaged employees are more likely to provide positive customer experiences, leading to better outcomes for the business.

Earned Wage Access Benefits for Employees

Financial stress often leads to turnover, with financially stressed employees being twice as likely to job hunt, as reported in the 2022 PWC Employee Financial Wellness Survey. Financial challenges increase stress and can lower both morale and productivity.

In fact, more than 8 in 10 employers agree that financial wellness programs foster more productive, loyal, and engaged employees.

What to Look for in an Earned Wage Access Provider?

When choosing an earned wage access provider, consider several key factors for your company:

- Regulatory Expertise: Assess the provider’s experience navigating regulatory requirements.

- Company Fit: Check if the provider has experience with businesses of your size and can meet your specific needs.

- Employee Experience: Ensure the provider will enhance the overall experience for your employees.

- Security Standards: Review their security and privacy practices to confirm they protect sensitive information effectively.

See Why Companies should use My Day Pay Day

Empowering for Employees

Employees can access up to 100% of their MyDayPayDay balance, giving them more control during unexpected financial situations.

Easily see earned wages and withdrawals in a simple app, making it easier to plan finances.

Employees can use the service with any existing bank account, making it flexible and convenient for all.

Zero Hidden charges and interest

Improve your credit score without risk of high interest debts.

Easy and Safe for Employers

MyDayPayDay manages everything smoothly, with no changes required to your existing payroll processes.

Connects effortlessly with HR, payroll, banking, and benefits systems for a seamless experience.

Enterprise-level security ensures data privacy and keeps the service running, always available when employees need it.

Witness positive impact on employees' financial wellness in turn increase in productivity.

Zero Liability for Employers